Identity theft or fraud can happen to anyone.

At First Bank Hampton we have tips and resources to empower you in the fight against identity theft and fraud. And the more you understand about identity theft and fraud, the better prepared you are to help us fight identity theft and fraud and keep your financial accounts safe.

Keep your eyes open for fraud.

It’s important to monitor your financial information and keep your eyes open for fraud. These simple steps can make a big difference in the security of your financial information.

You’re entitled to one free credit report a year. Use your credit report to monitor:

- Your identification

- Unfamiliar accounts or charges

- Suspicious activity

Sign up for Credit Sense and monitor your credit report monthly. Credit Sense is a free feature within online banking. It is easy to sign up and provides provides you a wealth of credit information.

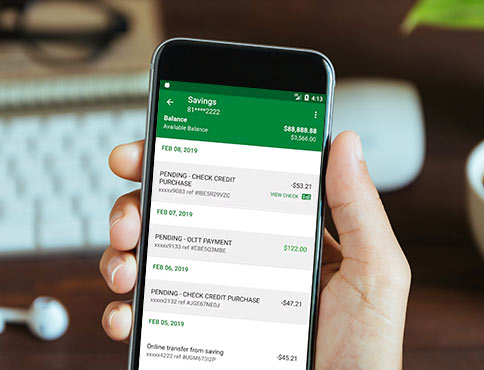

Watch your bank account and monthly statements closely and know your billing cycles.

Be vigilant at ATMs. If something seems suspicious contact your financial institution.

- Cover the pin-pad with your hand while entering a PIN.

- Use familiar ATMs in well-lit areas.

- Watch for shoulder surfing — a camera positioned to obtain your card number.

- Look for skimmers placed over the ATM card slot.

Necessary steps to take if you detect fraud.

If you suspect identity theft or fraud, contact First Bank Hampton and the SHAZAM Fraud Department immediately. Then, follow these steps to get your life back on track:

- Place a fraud alert on your credit reports.

- When you place an alert on your credit, this will prevent any other accounts from being opened.

- You can request a report to see if any charges seem suspicious.

- When you place an alert on your credit, this will prevent any other accounts from being opened.

- Close your First Bank Hampton accounts you think could be affected.

- Follow-up in writing with copies of any supporting documents.

- Ask us for the correct paperwork to dispute existing debits on your accounts, or any newly opened accounts.

- Follow-up in writing with copies of any supporting documents.

- File a complaint with the Federal Trade Commission (FTC) at 877.438.4338 or ftc.gov/idtheft

- When you file with the FTC, you’re providing information to help law enforcement officials track down thieves.

- Print your ID theft affidavit from the FTC and take it to the local police

- When you file with the FTC, you’re providing information to help law enforcement officials track down thieves.

- File a report with the local police.

- Filing a police report, along with a complaint to the FTC, can add safeguards to ensure your identity can be protected and restored.

- Filing a police report, along with a complaint to the FTC, can add safeguards to ensure your identity can be protected and restored.

Other important numbers and websites include:

- SHAZAM

Lost or stolen card 800.383.8000

SHAZAM Fraud 866.508.2693

shazam.net - U.S. foreign travel information

888.407.4747

travel.state.gov - Federal Trade Commission

877.438.4338

ftc.gov/idtheft - Free Annual Credit Report

877.322.8228

annualcreditreport.com

Credit bureaus

- Equifax

Place an alert 800.525.6285

800.685.1111

equifax.com - Experian

888.397.3742

experian.com - Trans Union

800.916.8800

transunion.com

Fraud can happen when you least expect it. Stay alert and be attentive. Contact us for other ways you can be proactive and keep your financial accounts safe.